International Market Overview

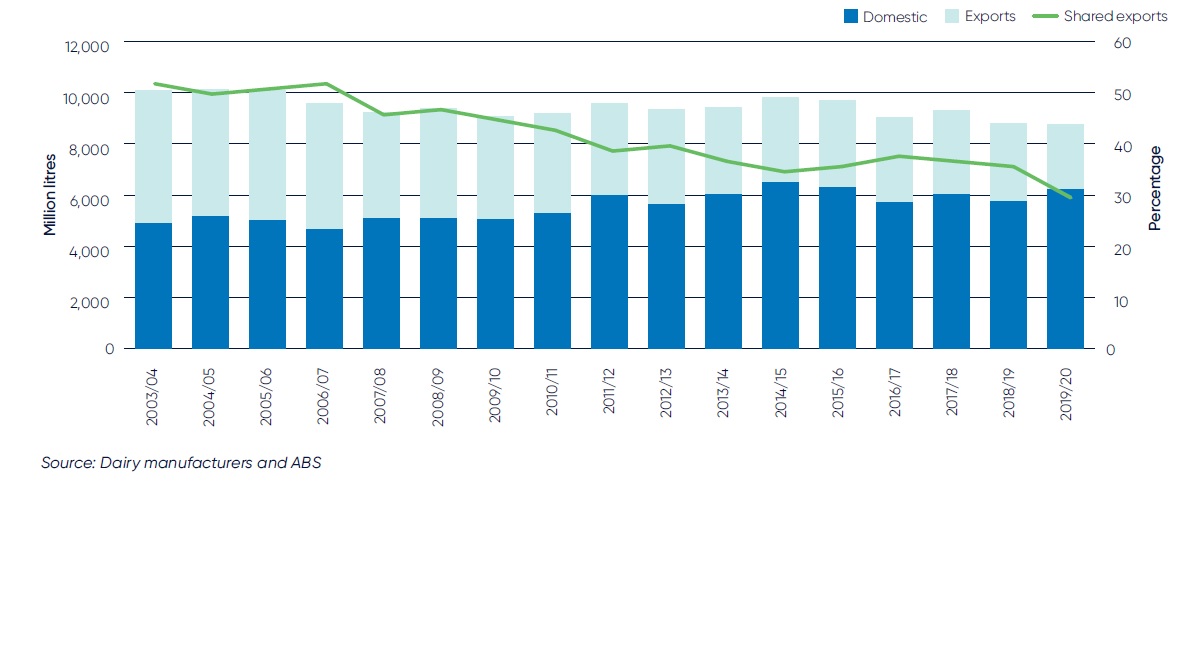

Australia exports roughly one third of milk produced each year, making it the fourth largest dairy exporter in the world. This is because Australia’s milk production exceeds the volume required for domestic consumption.

The share of total production destined for export has ranged between 30% to 60% since 2002–03. In more recent years Australia has exported close to 30%–40% of its milk production. The share of Australian milk exported has reduced following a decline in overall milk production and a larger domestic market due to population growth.

Australia accounts for less than 2% of the world’s estimated milk production but remains a significant exporter of dairy products. Australia currently ranks fourth in terms of world dairy trade, with a 5% share behind New Zealand, the European Union and the United States.

Dairy exports to Asia

Greater China (including China, Hong Kong and Macau) is Australia’s largest dairy export market, accounting for 32% of exports by volume. Japan remains a vital trade partner for Australian exporters as a mature, high-value market with long-established business relationships. Australian dairy exports to Asia account for more than 87% of total exports. In 2019–20, the total value of Australian exports was around A$3.4 billion.

Australia’s concentration of exports to Asia reflects the geographic proximity to these markets and the extent to which Australia has been excluded from other major markets by direct restrictions, which is the case with the European Union. Increased competition in key importing markets has also played a role in creating this concentration. Asian markets have considerable potential for consumption growth as incomes rise and diets become more ‘westernised’. Australian dairy companies also have proven track records in supplying these markets over several decades.

Australia’s top five export markets by value in 2019–20 were:

- Greater China

- Japan

- Indonesia

- Malaysia

- Singapore

Australia’s top five export markets by volume in 2019–20 differed only slightly by order. They were:

- Greater China

- Japan

- Singapore

- Malaysia

- Indonesia